Who’s Really Paying for This Sh*t?

The rural-urban tax blame game is a distraction from a broken funding system that’s squeezing everyone but the ones cashing checks.

Who Do You Think Pays for the Snowplows, Bro?

Even though I’m in Illinois, I don’t live in Illinois. That said, I pay taxes in Illinois, and over the years I’ve never cared for how steep they are.

For clarity: this isn’t about all taxes, or even all spending. It’s about the way Illinois funds K-12 education, because that’s where the pain point is, and where the misunderstanding lives

The other day, I was breaking down how this so-called “Big Beautiful Bill” is going to be a “Big Beautiful Bullet” aimed right at rural Illinois - you know, the parts of the state that already have crumbling hospitals, and no jobs, inside the state with the second-highest property taxes in the country. I pointed out that a lot of these counties are barely hanging on, and cutting federal supports like Medicaid and SNAP is only going to make that worse (and yes, they voted for this, but still).

I also mentioned, almost in passing, that the property taxes in Illinois are outrageous and a large part of the problem in rural areas. This house is in a rural part of the state, and I pay over $2,000 a year on a house that’s not even worth $100,000, a tax rate you don’t even see on half-million-dollar homes in other states. The comment section mostly agreed… until one person who didn’t bother to listen showed up to scold me.

“Who do you think pays for the schools and the snowplows, bro? That’s your property taxes at work!”

It was the classic knee-jerk response - delivered with the smug certainty of someone who clearly didn’t pay attention to the video. So I posted a follow-up, explaining that my gripe isn’t with paying property taxes, instead it's with how much I'm being charged and why including the fact that over 50% of the property tax bill is for education, because Illinois has an educational funding method that is, in my opinion, quite bad.

Suddenly, a few people from Chicago were chiming in to say that they were footing the bill for all the poor, dusty downstate schools, and that without Chicago’s property taxes, the rest of Illinois would be sitting in the cold without stop signs or teachers. Some insisted that Chicago’s property taxes were propping up the whole state’s Education system. One even told me to “do more research”.

So I did.

That’s what this piece is about: the education slice of the bill. Snowplows and streetlights aren’t what I’m dissecting here.

Separating The Myth of the “Chicago Property Tax Subsidy” From Everything Else

Before we get too far into this, let me be clear about what this section is and what it’s not.

This isn’t a hit piece on Chicago or a defense of rural Illinois. I really couldn’t care less about this odd contest. This is specifically about one claim that keeps popping up in comment sections and conversations alike:

“Chicago’s property taxes are paying for the rest of the state’s schools.”

This is what I decided to take a look into. Not just opinions. Not just vibes. Actual tax data, revenue expenditures, education budgets, and some random examples from across the state.

Here’s what I found:

Yes, property taxes in Chicago are absurd. They’re high, and a huge chunk of that money does go toward education. That part’s true.

But outside of the state’s general fund taxes (income, corporate, sales, etc.,) that money stays in Chicago. Since 75% of Illinois lives in the Northern part of the state, obviously that revenue is going to be the primary source for general funds. However, I found zero evidence that Chicago property taxes get funneled into rural or outside school districts. It doesn’t hold up the rest of the state’s education system by its property taxes. In fact, the way Illinois is structured, it’s almost the opposite: every district is left to fend for itself, and the property tax burden falls hardest on the places least able to afford it.

Now, are there bigger problems at play? Absolutely.

The entire state education budget is underfunded. Illinois has a massive pension liability, which eats up a ridiculous amount of money. And yes, that has to do with political decisions made years ago, and I’m not here to rehash that. I support pensions. I think they’re worth saving. But we can still acknowledge that the math is a mess without blaming the concept.

There’s also the so-called “Evidence-Based Funding” model Illinois uses, which appears to be the latest in a long line of attempts to make funding more equitable. But if this is the best they’ve come up with, it’s not cutting it. The bottom line? The state is supposed to be funding education. That’s in the Illinois Constitution. But it doesn’t. And somehow, the courts treat that part of the Constitution like it’s just a suggestion.

So let’s get this straight:

I’m not here to argue that Chicago and Northern Illinois don’t pay more into the state. They do. Northern Illinois is 75% of the population, Central Illinois makes up another 10%, and everything south and west of that is barely a sliver by population comparison.

Yes, Chicago props up the state in a lot of ways. But city property taxes specifically do not subsidize rural education. That’s the myth. And now that we’ve named it, let’s break down why it’s wrong, and provide some insight into what is correct.

Where Illinois Property Taxes Stop

Let’s start by drawing a basic line between three totally separate things: local property taxes, state-level funding, and federal funding

When people see their massive property tax bill and notice that over 50% of it goes to “education,” it’s easy to assume that money is being distributed across the state like some kind of big communal education pot. But that’s not how it works. At all.

Local property taxes fund local school districts. Period.

They’re collected by the county, routed through local taxing bodies, and used by the specific school district where the property is located. If you own a house in Peoria, your property taxes go to Peoria School Districts If you live in Naperville, they go to Naperville’s schools. If you’re in Chicago, your money goes to CPS.

The confusion usually comes from this:

Yes, Chicago and Northern Illinois generate the bulk of the state’s income, corporate, and sales taxes. That’s what fills the state’s General Fund, and that money does get distributed across the state for a lot of things: infrastructure, pensions, public aid, and yes, education.

But that’s a completely different stream of money than local property taxes. It’s like saying your neighbor pays off your credit card because you both shop at the same Walmart. No. You’re both part of the same ecosystem, sure, but your bills are still your bills.

So when someone says, “Chicago’s property taxes are paying for downstate education,” they’re just plain wrong. That’s not how the flow works.

If anything, the real is that every part of Illinois is forced to rely way too heavily on local property taxes to fund basic education at all. Which is a terrible, regressive way to do things, especially in lower-value areas where a high tax rate still doesn’t generate enough revenue.

Let’s break this down with some examples.

Some Real Examples By County (Not By School District)

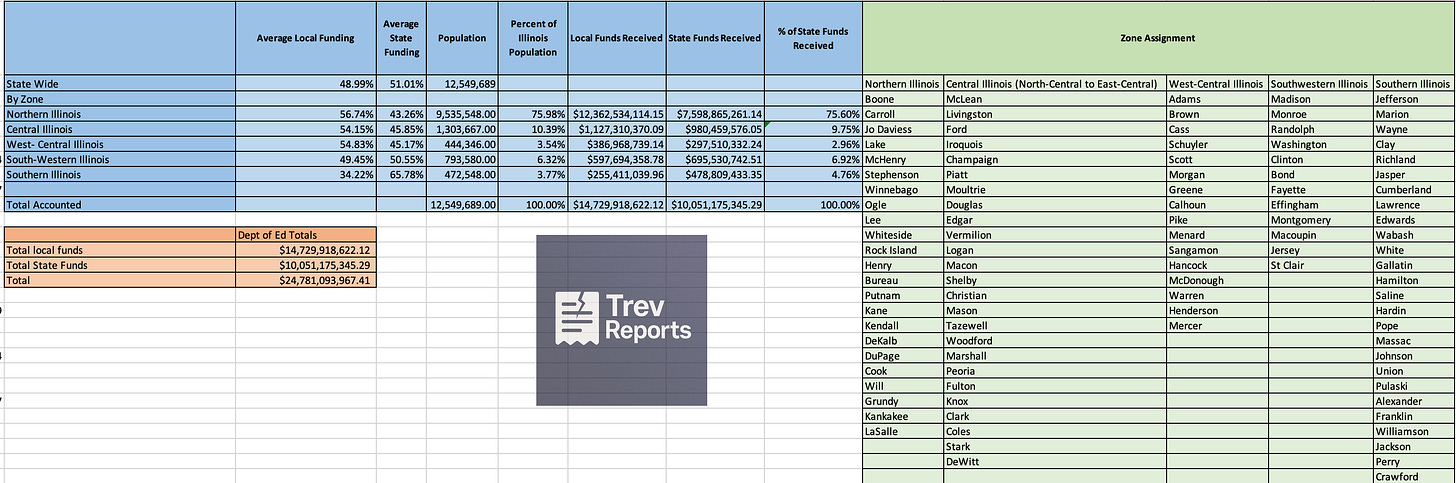

We’re not looking at property tax rates here, only at how school funding actually breaks down by local and state share (excluding federal). These numbers come straight from ISBE and local government data, and population data from “Illinois Demographics” census database.

Northern Illinois

Population (2023): 9,535,548

Example County: Cook

Local Funding: 58.73%

State Funding: 41.27%

Central Illinois

Population (2023): 1,303,667

Example County: Champaign

Local Funding: 65.95%

State Funding: 34.05%

Southern Illinois

Population: 472,548

Example County: Madison

Local Funding: 51.43%

State Funding: 48.57%

You get the idea.

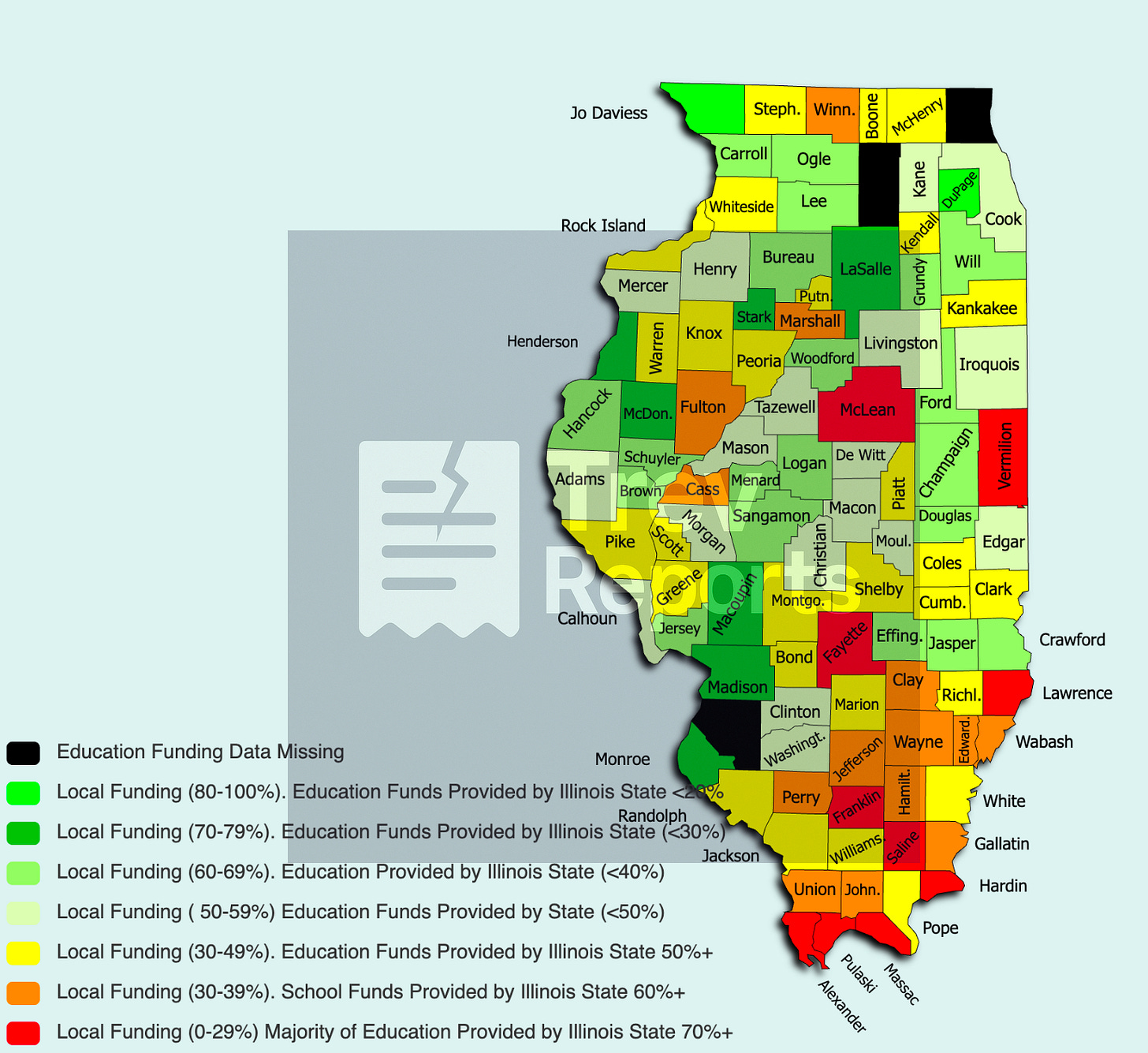

Generally speaking, people tend to prefer data visualized, so I created a map with the county-level values averaged in by school districts in the county, and I’ve also broken the counties into zones to see how the distribution works around the state.

What the Data Shows - And What It Doesn’t

What this data does show is that in most parts of Illinois, local governments pay for at least half - and often more - of their own education budgets through property taxes. State funds cover the rest, usually around close to the other half. That’s the average.

In northern, central, and west-central Illinois, local funding typically makes up the majority share, and south-western Illinois covers half on average. Meanwhile, in southern Illinois, it’s the opposite: state funding covers a larger portion of the cost, meaning the rest of the state is picking up the slack.

This fits with the broader truth: since around 75% of Illinois’ population lives in and around Chicago, general fund revenue comes disproportionately from the north. So yes - Chicago and northern Illinois do generate the majority of the state’s overall education dollars.

But here’s the critical distinction:

That money flows through state-level taxes. Not through Chicago’s property taxes.

Even in Chicago, where residents are shelling out absurd amounts in property taxes, those dollars don’t go to other towns or counties. They stay local. And Chicago is fighting the same uphill battle as everyone else: trying to fund schools off of property taxes because the state itself isn’t stepping up.

So the debate shouldn’t be about Chicago paying for downstate schools. It’s about whether the state is distributing its general funds fairly, and whether it’s even fulfilling its constitutional duty to begin with. Given that, it’s important to note that based on a purely population-level distribution, the only areas receiving noticeably more than their fair share by population-to-funding-metrics is the southern areas of Illinois, and to lump rural areas in the other parts of Illinois in with the south is blatantly inaccurate. That said, a"percent from the state" is not the same as "total dollars adequate to educate kids." Rural areas need the state's help, and they still don’t get enough.

This Non-Illinoisian’s Opinion

Education is a public good. Everyone should be paying into it. I’d gladly see more federal money go to education and less to programs like ICE. Insufficient education is likely a significant problem that has created the critical thinking issues existing at the state and national levels.

That said, in Illinois, education funding is a state responsibility, and Illinois is failing to meet it. When most areas of the state are still relying on property taxes as their primary source of school funding, the system isn’t just broken - it’s upside down.

Rural Towns Are Getting Squeezed And It’s Not Just Their Fault

Let’s get one thing clear up front: the cost of running a school doesn’t magically drop just because you’re out in the middle of nowhere. Teachers still need to get paid. Tech contracts don’t come with a “small town discount.” Gas still costs what it costs. And if anything, rural schools sometimes end up paying more just to get the same services beamed in from elsewhere. You think Comcast cares that your town has 800 people instead of 80,000? Nope. They’ll still bill you like you live next to a skyscraper.

And yet these districts, the ones with shrinking populations and zero commercial base, are still trying to keep the same basic services going. That math doesn’t work. And it sure as hell doesn’t work when your tax base is made of cornfields and the memories of when there were three restaurants.

Let me lay it out simply. There are a handful of massive problems hitting rural counties all at once:

There are fewer people to tax. This isn’t a “we're just a little town” thing - it’s a whole regional collapse thing. Only about 25% of Illinois’ population lives outside the Chicago metro area, and if you’ve driven around lately, you know damn well most of those towns aren’t growing. They’re hollowing out, and 100% of Illinois lives in a state that’s 75% farmland.

Most of the land is zoned for agriculture, and that land gets taxed at a sweetheart rate that might’ve made sense back when it was local family farms and the money stayed in town. But today? Most of these farms are consolidated, leased, or straight-up owned by out-of-state corporations. The revenue’s gone. The stores are gone. The tax dollars are gone. And the land still gets taxed like it’s sacred.

There’s no commercial cushion. Do you think businesses want to move into a county with a dying population, sky-high property taxes, and no foot traffic? They’re not coming. Now it’s just the homeowners holding the bag.

So what happens? Your school district decides it needs more money (like ours just did). They already have $17 million in cash sitting in reserves and they wanted another $25 million on top of that. For a county-level school district with 1,200 students. In a county where everyone’s already drowning in property taxes. There are clearly other issues there - Anyway -

You end up with a setup where:

Grandma gives up 2-3 social security checks on her paid-off house’s tax bill

Nobody wants to move in

People keep moving out

Businesses avoid the area

There’s no new real estate for growth

The farms don’t pay their share

And the people still here get stuck paying more for less every single year

This isn’t a sustainable setup. It’s a collapse where the people who are paying the price are the ones who stuck around.

Where rural areas are getting it twisted.

Folks downstate love to rail against Chicago like it’s the reason they’re broke. But listen carefully southies: your local taxes are staying local, and they aren’t Chicago’s fault. What’s keeping your school open isn’t coming from city property taxes - it’s coming from state funds, which do mostly come from Chicago and the surrounding burbs, because that’s where most of the economic activity in the state is.

So no, nobody in the city is taking your money - and if any administration is taking your money, it’s your own town’s - If anything, Chicago is helping your town stay alive. The fight is over how that state money gets distributed, and a whole lot of people out here are angry at the wrong side of the map.

And look, I know it’s hard to take the moral high ground when you feel like you're constantly getting screwed. I get it. But this whole you-vs-them thing? It’s bullshit. It’s manufactured by people who benefit from rural towns collapsing and urban folks getting blamed for it. You want to be mad? Be mad at the policies that have let massive farms dodge taxes while schools threaten to close and irresponsible pension decisions 40 years ago. Be mad at the bond measures pushing fake numbers on broke counties. Be mad at the system that makes it harder to get a decent education just because you live 100 miles from a Starbucks.

But don’t be mad at each other (for education). Because like it or not, you’re all in this state together, and if you don’t figure out how to start fighting alongside each other instead of against, the only ones left standing will be the ones who never gave a shit about any of you to begin with.

What Actually Needs to Change

At this point, it shouldn’t be about pointing fingers anymore. It’s about fixing how Illinois funds public education, because the property tax system wasn’t designed to carry that burden to this degree, and it’s failing. The truth is, it’s obvious what needs to change, politicians just keep dancing around it because no one wants to piss off the people who benefit from the current mess.

Option 1: The State Needs to Step Up

Stop pretending this is sustainable. When the majority of Illinois districts are still funding over half their own education budgets through massive local property taxes, something is deeply broken. The entire point of having a state education system is that people pool resources so kids don’t get punished just because of where their parents happen to live.

That means:

Shift the load away from local property taxes and onto the state. Let the General Assembly do what it’s supposed to do and fund public education like a public good, not a county-by-county GoFundMe.

Use a weighted funding model like almost everyone else. That means if a district is facing geographic, economic, or demographic disadvantages, they should get more help, not be forced to squeeze blood from a stone. A town with 300 people can’t be expected to shoulder the same raw financial load as a suburb with 50,000 and a Costco.

If the state doesn’t start correcting these imbalances, rural towns are going to keep getting gutted, and the kids in them are going to keep getting shortchanged.

Option 2: Stop Letting the Property Tax System Wreck Small Towns

Property tax was never meant to be the lifeline of public education, but in a lot of places, that’s exactly what it’s become. And it’s a bad fit, especially in rural areas where you’re taxing farmland and unsellable empty homes like they’re a functioning economy.

Here’s what has to change:

Stop treating 2,000 acres of subsidized farmland like it still benefits the surrounding community. It’s not. The current classification system is outdated, and it’s actively punishing working people while major landholders skate by.

Rebalance the burden. If your town has 1,200 students and 9,000 residents, you can’t just crank up the levy every year and expect homeowners to keep taking it on the chin. Cap the damage. Create regionally adjusted tax expectations. Do something, anything, that acknowledges the math simply does not work when populations shrink and costs stay the same.

Because right now? The only thing it’s really doing is accelerating the collapse. And all the while, people are fighting each other over scraps while the real beneficiaries sit back and cash checks on the coast of wherever it is rich people live.

Final Thoughts: Let’s Be Real About the System

Let’s just stop bullshitting each other.

Yes: Chicago drives the state’s economy. Nobody sane is denying that. The Chicagoland area accounts for a huge chunk of Illinois’ GDP, and yes, urban areas pay a massive share of state taxes. That’s just facts.

But when people start saying things like, “My property taxes in Chicago are paying for your rural teachers,” that’s where the train flies off the rails.

That’s not how this works.

Property taxes are local. Always have been. Your local property taxes stay in your local district. So no, you’re not funding Rural Joe’s town’s school just because you’re paying through the nose in Cook County. What you are funding, through your state taxes, is the same thing the rest of us are: a broken, lopsided system that nobody seems willing to fix.

This isn't about attacking cities, and I’m definitely not going after teachers. This is about calling out the fact that rural communities are being squeezed harder every year, and it looks like no one in Springfield wants to touch it, because it’s easier to let people believe lazy myths than to face the numbers.

What I’m trying to say is simple:

Rural Illinois is drowning.

Everyone in Illinois is being punished

The “Evidence-Based” equalization isn’t equalizing

Tying Education funding to property taxes is almost always broken

And instead of blaming each other, maybe it’s time to blame the system that’s keeping everyone stuck.

You can fund public education like a public good, or you can keep grinding communities into the dirt while pretending it’s their fault they’re poor.

Your call, Illinois.